Around 90% of stock mutual funds underperform index funds, while charging higher fees. Why would you pay more, for getting less? In this blog, you will learn all you need to know about Fidelity index fund investing! We’ll cover: What index funds are, why to choose Fidelity index funds, tips on how to create a portfolio of Fidelity index funds, how to buy Fidelity index funds.

What are index funds?

Index funds are investments of stocks or bonds that mimic the composition and performance of a market index. A common market index that you hear about in the news is the S&P 500, which is a list of 500 large U.S. companies developed by Standard and Poor. Another one is the Dow Jones Index, which is a stock market index of 30 prominent U.S. stocks.

There are index funds for small companies, for real estate stocks, etc. What makes an index fund unique is that it is passively managed. This means if I’m the fund manager of the Fidelity 500 index fund, I’m not trying to analyze each stock and pick ones that I think are going to outperform. That’s what an actively managed mutual fund does. If I’m the fund manager of the Fidelity 500 index fund, which mimics the S&P 500, I’m just going to buy the 500 stocks that comprise the S&P 500.

Why choose index funds?

You might wonder if picking individual stocks, or having someone actively manage your funds is better. Maybe you heard of someone becoming rich doing that. Maybe you look at mutual funds in your 401(k) and see some that perform quite well. So wouldn’t those be a good investment choice?

These are anecdotes. A 1 year or 3-year performance doesn’t really tell you that much. A smarter approach would be to look at a robust set of data over the long-term across many types of investments. Let’s look at the data over the last 20 years, from 2001 to December 2020. What does the data tell us?

- 88% of small and mid-cap stock funds underperformed their benchmark index.

- 96% of large-cap core funds underperformed their benchmark index.

- 91% of international stock funds underperformed their benchmark index.

- 92% of emerging market stock funds underperformed their benchmark index.

This superiority of index funds does not apply to just stocks. It also applies to bonds.

- 91% mortgage-backed bond funds underperformed their benchmark index over a 15-year period.

- 98% of high yield bond funds underperformed their benchmark index over a 15-year period.

Why Fidelity index funds?

We will start by saying we are not affiliated with Fidelity, nor do we get compensation from them. We are sharing with you our independent analysis. There are two main reasons we recommend Fidelity Index investing over other brokerage companies.

First, Fidelity index fund expense ratios or fees are one of the lowest out there. It’s even lower than Vanguard index funds, which spearheaded the concept of index investing back in 1976. Let’s take a look at the list of Fidelity index funds, and do a side-by-side comparison with Vanguard index funds.

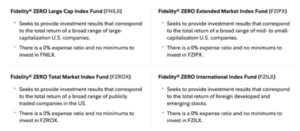

As you can see, all 24 of these Fidelity index funds have lower fees or expense ratios compared to Vanguard index funds. Fidelity has gone even further and one-upped everyone by introducing four Fidelity zero-fee index funds.

ZERO fees. That’s hard to beat.

The second reason we recommend Fidelity is that Fidelity index funds have no minimums to open an account. In contrast, most Vanguard index funds require $3,000. Now that you understand the advantage of investing in Fidelity index funds, the next question then is how to start.

To find out more, visit our website.

Comments are closed.