Are your hard earned bank holdings insured? Luckily for the majority of Americans, they are. The Federal Deposit Insurance Corporation (FDIC) is an independent government agency that is in charge of banking and consumer safety. The FDIC insures your bank deposits, up to a limit, in the event of a bank failure. In this blog, we are going to look at what FDIC insurance is, the limit for FDIC insurance, and how you can maximize your coverage.

Are your hard earned bank holdings insured? Luckily for the majority of Americans, they are. The Federal Deposit Insurance Corporation (FDIC) is an independent government agency that is in charge of banking and consumer safety. The FDIC insures your bank deposits, up to a limit, in the event of a bank failure. In this blog, we are going to look at what FDIC insurance is, the limit for FDIC insurance, and how you can maximize your coverage.

What is FDIC insurance and how does it work?

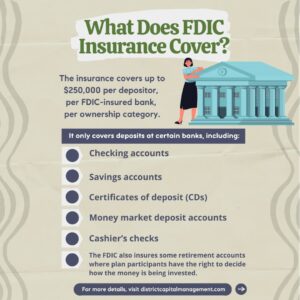

FDIC insurance safeguards your money at any FDIC-insured bank in case that bank fails. The insurance covers up to $250,000 per depositor, per FDIC-insured bank, per ownership category. If you opened a savings account with $125,000 and then you made $25,000 in interest then you would be insured for $150,000. If you have more than $250,000 in deposits across several accounts in a single bank, then you are only insured for $250,000.

When was FDIC insurance created?

The FDIC was established by the Banking Act of 1933 during the Franklin D. Roosevelt administration. Before FDIC insurance was created, thousands of banks collapsed and many account holders lost a lot of money. While another bank failure is unlikely, it could still happen and you will want to know that your money is protected.

What does FDIC insurance actually cover?

The FDIC insures up to $250,000 per depositor, per institution and per ownership category.

FDIC insurance only covers deposits at certain banks, including:

- Checking accounts

- Savings accounts

- Certificates of deposit (CDs)

- Money market deposit accounts

- Cashier’s checks

- The FDIC also insures some retirement accounts where plan participants have the right to decide how the money is being invested. This includes some IRAs and 401(k)s.

What isn’t covered by FDIC insurance?

FDIC insurance does not cover:

- Contents of safety deposit boxes

- Investments in stocks, bonds, or mutual funds

- Losses from investments

- Life insurance policies

- Annuities

- Payment providers such as Paypal and Venmo

If any of these apply to you, please talk to your financial advisor to ensure that they are protected.

Do I need to apply for FDIC insurance?

You don’t need to apply for FDIC insurance. When you open an account at a bank, you may notice the account is FDIC insured. As long as you open an account with an FDIC insured bank then you wilL be covered for up to $250,000.

What is the limit for FDIC insurance in 2022?

There is a $250,0000 FDIC insurance limit per depositor, per institution and per ownership category. Here are some examples of FDIC insurance coverage. It is important to think about your individual scenario to make sure that you are covered.

1. You’re single, do your banking at two banks, and you have:

- $200,000 in a savings account at Bank 1.

- $50,000 in a checking account at Bank 1.

- $150,000 in certificates of deposit at Bank 2.

That is a total of $400,000 deposited at two banks. Therefore your money is protected because you have $250,000 at bank 1 and $150,000 at bank 2.

2. You’re single, do your banking in one place, and you have:

- $200,000 in a savings account.

- $125,000 in a checking account.

- $100,000 in certificates of deposit.

That is a total of $425,000 deposited in one bank. FDIC insurance will only cover up to $250,000, therefore you would lose $175,000 if something happened to the bank. If this is your current situation, then we recommend that you put at least $175,000 with another bank so that you’re money is protected.

3. You’re married, you both do your banking at the same place and together you have:

- $500,000 in a joint savings account shared with your spouse.

- $250,000 in a certificate of deposit in just your name.

That’s a total of $750,000 deposited at one bank. All of this money is protected. You are both protected for $250,000 each for the joint account. The $250,000 in the certificate of deposit is also covered because it’s in just your name which is a different ownership category.

How can I maximize my FDIC insurance?

If you have more than $250,000, the most simple option is to have the money in multiple bank accounts at multiple banks.

You can also technically qualify for more than $250,000 in coverage if you have accounts in more than one ownership category. For example, a joint account is insured for up to $500,000 ($250,000 per co-owner). Then if each of those co-owners opens an individual checking account separately, those accounts woud also have their own $250,000 coverage on top of the joint $500,000 coverage.

Another option is to set up a revocable trust. You can then name one or more beneficiary to increase your coverage. Each beneficiary then receives $250,000 of coverage. For example, a revocable trust account with one owner and three unique beneficiaries can be insured up to $750,000. This is a slightly complicated process so it’s important to talk to your financial advisor to make sure that it has been set up correctly.

Make sure your money is protected with FDIC insurance

Over the past 80 years, the FDIC have protected people’s money and provided financial peace of mind. FDIC insurance is essentially a free way to protect your money. Check your bank account/s to make sure that you are protected and aren’t exceeding the limits for FDIC insurance.

Comments are closed.