What should I expect from the stock market in the coming weeks?

Expect more volatility. It’ll likely continue to go up and down markedly depending on the news that comes in. By the way, this is typical of the stock market. The continued upward trajectory we’ve seen over the past decade – that’s the anomaly. People are discovering that it takes a lot of guts to remain in the stock market.

Why is my bank interest rate dropping?

Savings bank account interest rates have been dropping over the past several months, to currently around 1.5% (for online banks). That’s because the Federal Reserve has been cutting interest rates.

Last week, the Fed slashed rates again by a full percentage point to near zero, to stimulate the economy. Expect your bank savings rate to further drop.

What does this Federal Reserve interest rate cut mean for me?

It’s designed to help keep the U.S. economy from going into a recession.

Rates on credit cards, HELOCs, auto loans may go lower.

It may also make the U.S. dollar weaker, which may slightly improve future returns from international stocks and bonds (since foreign currencies relative to USD may become stronger).

Should I refinance my mortgage?

30-yr mortgage rates have been dropping since November 2018 and nearing an all-time low. Average is 3.36% as of this writing.

If you have a mortgage and it’s greater than 3.8%, call your mortgage lender to request a refi quote. If you’re a Costco member, get a quote from Costco lenders(typically have lower closing costs).

To get a quick estimate on your new PITI, use this online calculator.

Compare what’s your estimated monthly savings from the refi vs closing costs (which may range from $2,000 to $4,000). For example: If the closing cost is $3,000, and your monthly savings from the refi is $300/mo, then you recoup the closing cost in 10 months. This is a good deal. The bigger the outstanding balance and the longer you plan to keep the property, the more attractive refinancing would be.

However, if you’re already five years into your mortgage, restarting the clock back to 30 years is generally not a good idea, since you’ll end up paying more interest. Ask the lender if they can amortize it over your preferred number of years.

What’s Warren Buffet’s latest take on the Covid outbreak?

“Be greedy when others are fearful.” That is his all-time mantra.

It’s best to read his famous 2008 op-ed, at the height of the financial crisis.

You might be interested to know that Berkshire Hathaway (Buffet’s company) just boosted its stake in a major U.S. airlines company (Note: This is not a recommendation to buy that particular stock).

When will this be over?

No one can predict the future. Don’t try to time the market.

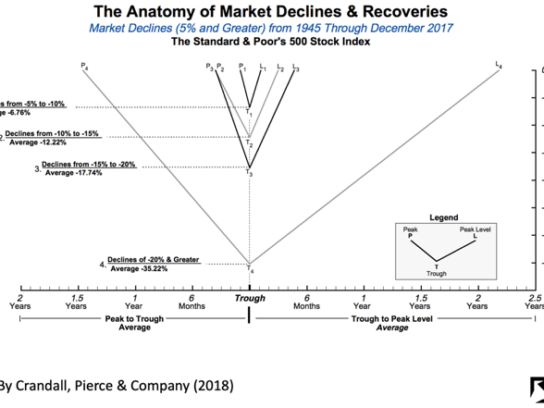

We do have rich data from the past seven decades of the U.S. stock market.

Based on the graph below, on the average, declines of 15-20% recover in about 8 months. Steep declines (20% or greater, represented by the bigger V line below), take about 3.5 years to recover, on the average.

So, if you don’t need the money over the next 3.5 years or more, you can just ride it out. (And during that time, collect dividends).

In terms of the actual Covid outbreak, we’re no expert on that. It will likely depend on how well governments respond, how fast they deploy testing kits and develop a vaccine, and how well people exercise social distancing.

Do you have any other cool graphs to share?

Click on this nice graph/simulation to see the importance of social distancing. (Blue is healthy; brown is sick; purple is recovered).

This article was written by Alvin Carlos, CFA, CFP®, Managing Partner of District Capital Management, Washington, DC.

Comments are closed.