Do you want to know how much you can contribute to a Roth IRA this year? The main benefit of contributing to a Roth is you will be able to grow your investments tax-free. However, if you deposit money into your Roth IRA while no longer being eligible (or more than the allowable amount), the IRS may charge you a 6% penalty.

This is where Roth IRA calculators come in. It can be an easy way to know how much you can contribute to a Roth.

Where can I find good online Roth IRA calculators?

I googled the term “Roth IRA calculator,” and the top three search results that appeared were calculators by Bankrate, Nerdwallet and Thrivent . Let’s look closely at each.

1) Bankrate’s Roth IRA Calculator

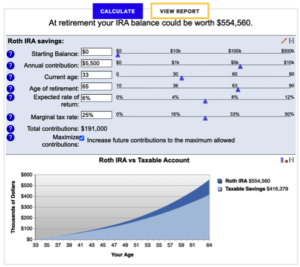

It sent me to a page where I was able to enter the following assumptions:

- $0 starting balance (better late than never)

- Annual contributions: $5,500 (and increasing future contributions to the maximum allowed; it would not allow me to put $6,000, which is the current max allowed)

- Current age: 33

- Age of retirement: 65

- Expected rate of return: 6% (stocks have historically returned around 10% per year, but we believe given the current stock market valuations, a 6% return is more reasonable for an aggressive portfolio)

- Marginal tax rate: 25% (assuming post-2025 tax bracket)

What does Bankrate’s Roth IRA calculator tell us? It tells us that if we contribute yearly to a Roth IRA based on the above assumptions, our money could be worth over $550,000 at age 65. That’s the power of compounding.

And that it generates a tax savings of close to $140,000. That’s the power of a Roth.

But wait, this calculator did not really help us determine if we are eligible for a Roth! Let’s go to the next one.

2) Nerdwallet’s Roth IRA Calculator

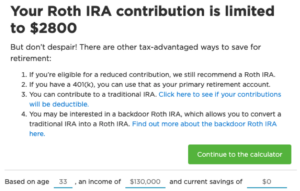

It’s asked me a bunch of questions. But this time, it also asked me about my gross income. I inputted $130,000. And it gave me this:

According to this calculator, given a gross salary of $130,000, I can only contribute $2,800 to a Roth IRA. This is what we are looking for! It’s below the maximum possible contribution of $6,000 in 2020, because the 130k salary is already in the phase-out range.

(Spoiler Alert: After double checking, Nerdwallet’s results are not accurate!!)

Let’s see what Thrivent’s calculator comes up with.

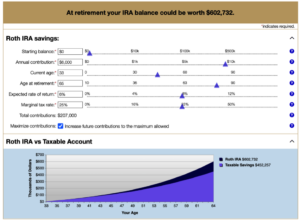

3) Thrivent Roth IRA Calculator

Weird. It looks exactly like the Bankrate’s Roth IRA calculator.

The only difference is it wouldn’t allow me to enter $5,500 for my annual contribution (so I can compare with Bankrate’s results). Anyway, this is also not what we’re looking for.

Which Roth IRA Calculator is Best?

The Nerdwallet’s calculator was pretty straightforward to use, in determining how much we can contribute to a Roth given a gross salary.

However, I personally like Fidelity’s Roth IRA Calculator.

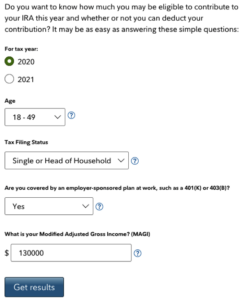

It looks like this:

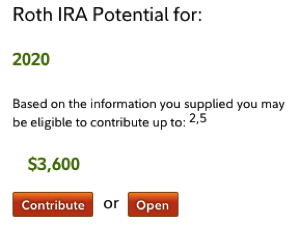

After I clicked on Get Results, it gave me this:

This is also what we’re looking for. The nice thing about this calculator is it asks the tax year the contribution is being made for, which gives a more precise calculation.

DISCOVERY: Notice that Fidelity’s calculator is telling us that we’re eligible to contribute $3,600, while Nerdwallet’s only said $2,800. I tend to trust Fidelity’s Roth IRA Calculator more, because it asked me for the specific tax year I was contributing towards. It’s very possible that Nerdwallet’s Roth IRA calculator is not updated. Meaning it’s likely assuming a maximum allowable contribution that is less than $6,000.

Final Word

Based on this exercise, I’m coming away with this main lesson: You can’t fully trust a quick Google Search! As we saw, two of the top three Roth IRA Calculators did not give us what we are looking for. And the one that seemingly did, gave us the wrong number!

Comments are closed.